Bowed by the weight of centuries he leans upon his hoe and gazes on the ground, the emptiness of ages in his face, and on his back the burden of the world.

– Edwin Markham

Today (21/06/2019) monsoon has officially arrived in Telangana,India .Not that city dwellers care about it, but a large number of people, who depend on farming, are awaiting for monsoon to fulfill their wishes and drench the thirst of their dried lands. This is not the wish of a section of people in Telangana, but it’s the wish of more than half of the population of India which depends on farming.

Agrarian crisis and removal of poverty are the main agendas in all the political parties’ manifestos during their election campaigns from the beginning of time in our country, but what political parties fail to establish strongly is 80% of the poor in India is dependent on farming directly or indirectly. Upliftment of poor will only be possible if we solve Agrarian crisis with long term road plan than a temporary solutions to woo the masses.

For better understanding what a farmer goes through, let’s look at a story.

Kailash comes from a family of long generation of farmers. His father and his forefathers were all rice cultivators. His father had 2 hectares of land, which is now evenly distributed between Kailash and his brother. The 1 hectare of land which Kailash inherited from his father is ready for another crop of paddy, but Kailsh keeping in mind of the water scarcity issue in his region he went against the idea of paddy and thought of cultivating tomato.(Fun fact:- It requires 2500 liters of water to produce 1kg of rice, however it takes only 214 liters to produce 1kg of tomato). He went to his local Cooperative bank and borrowed a loan of 1 lakh as an investment. He bought hybrid variety seeds and subsidized fertilizers for his cultivation. He took great care of his farm and used NPK (Nitrogen Phosphorus Potassium) in the recommended dosage. He installed a electric motor in his field to pump the ground water as his field is not connected to irrigation system. He bought good quality pesticides and provided good manure for better absorption of fertilizer by plants. After all this, his crop is almost ready and all he has to do is to harvest the crop, transport it and sell in the nearby market.

He took another loan of 20 thousand from a money lender in his village with high rate of interest than what bank provides. He hired few daily laborers and harvested the crop. Loaded everything into a tractor went to a nearby market to sell his fresh produce. By the time he got there all the spots near to entrance of market is taken up by other farmers, he came to know later that the remaining farmers came there by 3 A.M in the morning to get the sport in front of entrance. He cursed himself for coming late by 2 hours and settled in a spot which is a bit back. The buyers started coming and examined the produce from each farmer and started bargaining to a price which is 70% of what they expected. Most farmers refused and waited for other buyers to come and buy their product for a reasonable price, but everyone are bargaining at a very low rate. It’s almost afternoon and farmers are starting to get worried about their crop as it is losing its freshness. So they started to reduce the price they were asking than before, but the buyers are still dragging the price down. By evening, all farmers sold their crop to half of what they expected to get and few of them sold at even lesser price, Kailash is one among them. It only covered 60% his initial investment.

For the next crop too he took loan from the society bank, he repeated everything again except installing the electric motor. He used more fertilizers than recommended and as electricity is free, he pumped more water from the ground and watered his farm in expectation of higher produce. As the fertilizers are subsidized and electricity is free it didn’t cost him much. This time he went directly to the market where the middle men who bought his last crop are selling and tried to sell there, but he was objected by the trade union there as that union has a monopoly over that market only there union members are allowed to sell there. As he got nothing else to do he sold his crop to some middle men again to the same rate what he got last time.He also saw that these middle men are selling at a rate of thrice from what they bought from him. His expenses are increasing and he need to repay his loans with interests. He did the same thing next year, this year there is no monsoon and ground water levels are depleted. The produce he got is very less this time and the quality of crop is also very less.His money lender is pestering him for his money. His wife got sick in middle of all these and the hospital bills mounted up to his already mounting debt. He went in to depression from all these situations, but no one noticed what’s running in his mind. He felt humiliated of the repeated bank officers and money lenders visits to his home.He couldn’t take anymore and hanged himself to a tree in his own farm.

This is a tale of one Kailash and there are many Kailashs in India those who are going through similar or with different set of problems that’s leading to farmer suscides.

Ails of farmers

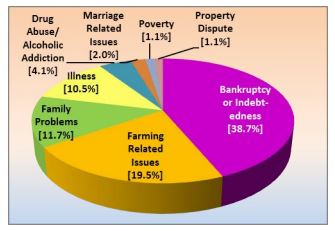

Farmer suicides is a horrifying issue which need an immediate action to curb it, as it shows a grim picture of farming and ultimately effects food security of India. Around 12,500 farmers at an average commit suicide every year in our country according NCRB data. All the issues of 12,500 farmers are not same.Check the below chart from NCRB for better understanding:-

As you can see only 38.7% of farmers commit suicide because of Bankruptcy. So all these political parties coming up with farm loan wavier are targeting this portion of farmers with loans in banks. Most of the farmers are still taking loans from informal sources like loan sharks and small chit funds. These loans will never be payed by government as they are informal. So addressing the issues behind the bankruptcy is the key to this problem than waving off loans. Here are few problems that needs to addressed which can bring down around 60 – 70% of the farmer suicides.

1) Awareness on water crisis and development of irrigation infrastructure

India is second largest irrigated country in the world only after China, but only one third of its agricultural land is irrigated remaining two thirds depend hugely on rainfall and ground water. Of the 12,602 farmer suicides in 2015, 4,291 farmer suicides are from Maharashtra itself. Vidarbha and Beed regions experienced less than 80% of normal rainfall. These regions produce sugarcane and cotton prominently. Sugar cane and cotton are wealth crops and need large amounts of water to grow. Growing sugar cane or cotton in regions like Beed where there is an acute rainfall shortage and depleted ground water levels shows how ill informed these people are about water crisis. Most of the old farmers choose sugar cane because of less labor in cultivating sugar cane. Even by the use of Drip irrigation technique they couldn’t achieve anything significant. Most of the irrigation canals in these areas are dry, however most rivers like Godavari and Krishna which originate in Maharashtra carries lakhs of liters of water into Bay of Bengal everyday. Construction of dams and interlinking of river basins are to be done on an emergency war footing scenario to address this issue. Projects like Kaleshwaram and Polavaram stands as an example for inter-linkage of river basins. Pattiseema project, which pumps Godavari water from Pattiseema to Krishna, helps in irrigation of almost Rs.2,500 crores worth of crop.Watch the documentary on water crisis titled 1000 feet under to get to know the situation in Beed region.

2) Lack of storage facilities and infrastructure

Farmers are not provided with storage facilities such as cold storage and weigh bridges in ground level. Without these facilities, farmers can’t demand a profitable price as he will be constantly worried about the freshness of his produce and he will sell his produce to a very less amount. Though government is taking measures in supporting farmers in form of transportation, infrastructure development will have a big impact on farmer’s income.

3) Middle men

Middle men create problems at ground level to farmers. These middle men have a monopoly over markets and force farmers to sell their produce at cheap rates. A strict government intervention is needed in controlling these unions. Programs like Rythu Bazar in Telugu states have to be encouraged. Rythu Bazars are places where farmers can come to the market and sell there produce directly to consumers by eliminating middle men. No charge will be collected from them for using the spot and in addition to that transport in state transport buses is also free to help them economically.

source:thenewsminute

4) Spurious seed rackets

Farmers invest money and time in producing their crop. Spurious seed rackets which take advantage of farmers replace original seed companies’ seeds with their fake seeds and sell to farmers. Farmers buy them and invest their time and resources by sowing in the fields, only to know later that crop is useless. This is a huge loss to farmer who is already reeling under various other pressures. Though government is seizing such outlets and checking transports which are transporting these fake seeds, these fake seeds rackets are still rampant throughout the country.

5) Inefficiency of government schemes and government officers at the ground level

Telangana government came up with a scheme called Rythu Bandhu. Through this scheme, state government annually provides Rs.8000/- to farmers for Rabi and Kariff crop seasons before he lays his crop so as to support him economically in buying fertilizers and seeds. This is a great initiative and even lauded by central government and even tried to implement it in central level. The problem with this scheme is this scheme is applied to only land owners. If a person is farming in a rented farm land, he is not eligible for this scheme, but the owner of the land with passbook who is not even farming gets the amount. Secondly, there is no cap on the number of acres of land a farmer can have to be eligible for this scheme. If there is a farmer with 100 acres he gets Rs.8, 00,000/- annually, this is a drawback on this scheme since a farmer with such huge lands is usually capable of investing in farming and he needs no assistance. As these schemes are extended to farmers with passbooks only, Ground level government officials won’t be giving passbooks to farmers without any personal gains for themselves and they won’t work efficiently to distribute them among farmers. Recent agitation of farmers regarding this issue shows how serious this situation is.

6) Free power and subsidies of fertilizers

Many state governments in India provide free power to agricultural sector. Providing anything for free will always produce negative side effects. Farmers started using this free power and pump out water from ground unnecessarily without giving a second thought. This is the main cause for depleting water levels in many places in the country. Repeated utilization of fertilizers or overuse of them has led to serious soil degradation in our country. Farmers without understanding the background working of fertilizers use more amount of fertilizers to get greater yields, but these fertilizers won’t be absorbed by plants instead travel through soil layers and contaminate ground water. The kidney failure issue in Uddanam is a lesson to governments for providing subsidies to fertilizers without educating farmers. It is estimated that 4500 people had died in the last ten years and 34,000 people are suffering from kideny related diseases. However, 70% of India’s Agri production growth is because of good fertilizers and sudden decrease in subsidies of fertilizers will make fertilizers un-affordable to small scale farmers. Installing of ground level work force to map the nutrients in soil and advising farmers in the usage of fertilizers will definitely help in overcoming this issue.

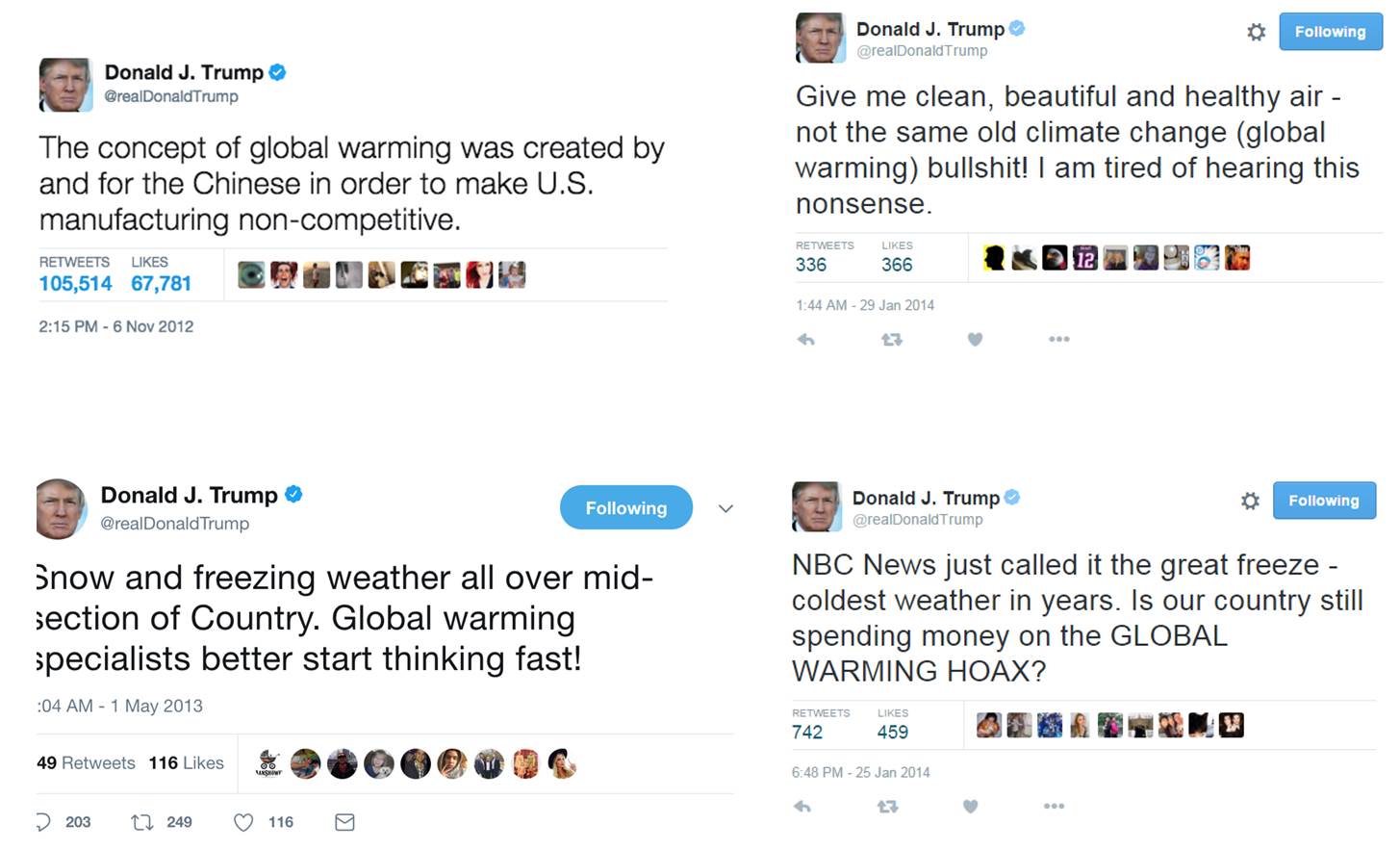

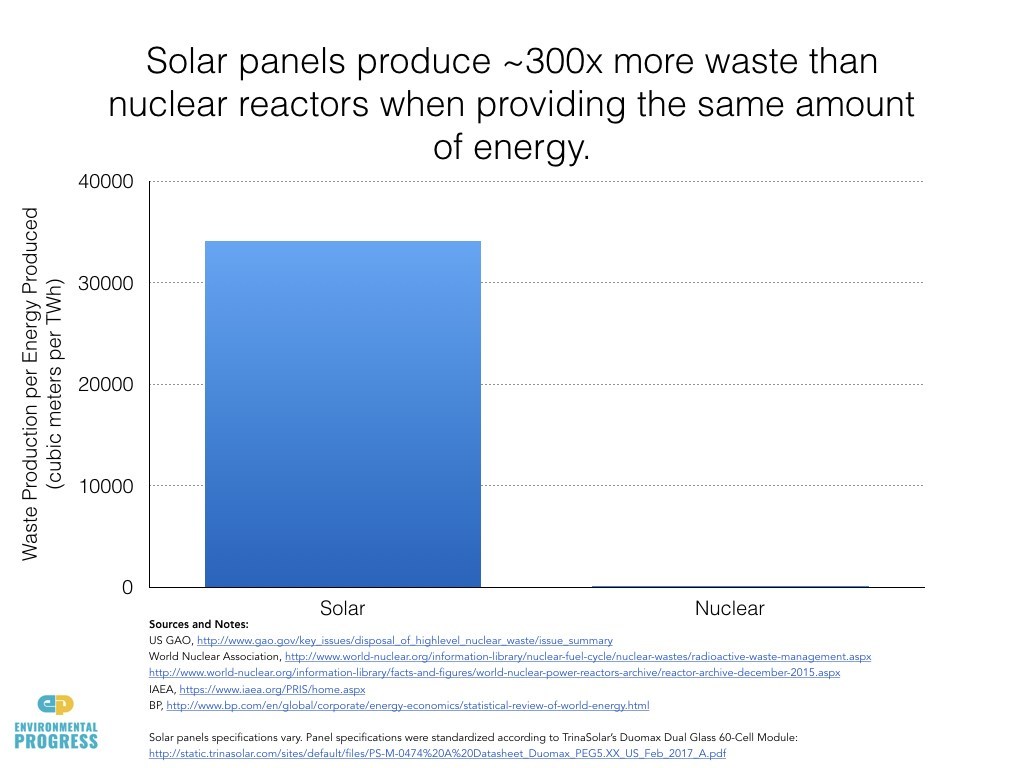

7)Climate change and changing weather patterns

Climate change though it is debated if it is even real or not, weather patterns are definitely changing. Kerala observed worst floods in a century, while its neighboring state Tamil Nadu is facing drought. East coast is constantly under a cyclone alert, whereas the west coast regions are facing less than average rainfalls. These inconsistent and unreliable weather pattern to a country like India where almost 70% of its farm lands depends upon rainfall is serious. Most of the farmers are uneducated and don’t know about crop insurances and government insurance schemes like Pradhan Mantri Fasal Bheema Yojana,etc.Government officials and NGO’s are to be encouraged to educated farmers at root level.

8) Lack of awareness on the necessity of crop rotation

Farmers who are used to traditionally cultivate one type of crop don’t change their crop over years and cultivate the same crop again and again. This leads to increased activity of disease causing microbes to that crop in the soil and crop diseases gets rampant destroying the yield in one go. By rotating the crops year by year or for every crop season this sort of situation can be totally controlled, but farmers feel this is a risk since they enter into new cultivation deviating from their traditional crop. NGO’s like CSA are working to bring sustainable agriculture to farmers. These organizations inform farmers to which schemes they are eligible and processes for obtaining the scheme benefits.

9) Changes in patent laws

Indian IP laws specify clearly that seeds and plants or parts thereof cannot be patented. Under Protection of Plant Varieties and Farmers’ Rights (PPVFR) Act, 2001 India opted to provide sui genesis legislation which provides intellectual property protection for plant varieties including transgenic varieties.To keep it simple it states that no company can patent on seeds, plants or plant parts in India. Genetically modified seeds(GM seeds) or BT seeds( Bacterial Thuringiensis seeds) are lab grown gene altered seeds. A gene of thuringiensis bacteria is taken and introduced to cotton, brinjan or corn seeds which makes these variety of seeds pest resistant, there by limiting the use of pesticide. BT seeds are developed by foreign companies and are used by 80% of american farmers where as they are completely banned in European countries, as their effects on humans are not well researched. But still these sort of new genetically advanced seeds which are developed by foreign companies will never enter into Indian markets if our patent laws are unfavorable to them. Lays sued four farmers for distributing there own variety of potatoes to other farmers without the company’s permission,however due to public outcry for going against the farmers Lays company backed off from the case. How can companies bring there products into our markets if we don’t have good protection laws for them? To make our farmers competitive in the global market these sort of seeds are a shot in the arm. Please follow the case of Monsanto Vs Nuziveedu seeds for better understanding.

10) Mechanization of farming

Traditionally Indian farming is done using wooden plough, sickle,oxen and huge labor working on the field. These traditional farming techniques have not yet changed even in the 21st century where remaining countries are replacing human labor with machines to increase quality and output of farming. Predominantly farmers in India are either small scale or medium scale. They own very less land and in some areas like West Bengal the average land holding capacity is around 0.5 hectares. Using of machinery in such small lands in costly and unnecessary. This created small patches of land owners in a very big cultivatable land who are unable to use machinery as it leads to huge investments. This scenario is same in many parts of our country. This is mainly due to inheritance practices which led to division of land between children equally creating small patch land owners. Government should encourage the idea of land banks, where all these small farmers will register their lands in land banks and create a big land where usage of mechanization becomes a viable option and costs less per acre. Profits will be shared among the farmers after the produce is sold

Secondly, a huge amount of farmers are leaving farming and taking up jobs as farm laborers. Though 55% of Indian population is in farming, agriculture contributes only 13- 14% of nations GDP. This is a very inefficient way of utilizing human resources. Mechanization will remove these jobs, but this human resource can be used in sectors like Industrial, infrastructure development and so on.

Though these are few issues in farming there are other issues like good health care schemes to farmers, pensions to old farmers, lack of innovative techniques like in Israel, addressing mental health of farmers, fluctuating MSPs,etc. Government of India should commit itself to long term road path. PM Modi’s promise to farmers to double their income by 2022 is a good vision but effective steps have to be taken in ground level to make that dream come true.

Kissan Mitra Helpline is an initiative by Centre for Sustainable Agriculture-a NGO based in Telangana, who takes calls from farmers in distress and listens to their problems. They have helped many farmers who are depressed and on verge of suicide. They send their Kissan Mitras who are on ground, go meet farmer and discusses solutions with them. They educate farmers on the available schemes, they intervened in many situations where farmers were not getting passbooks and they help farmers in moving towards sustainable eco-friendly agricultural practises. They solved more than 5000 farmer issues and are awaiting for government intervention in more than 4000 other cases.

Zero budget natural farming is another technique which has originated in Karnataka. This technique is being widely implemented by Andhra Pradesh Govt and UN lauded the steps taken by State government in order to promote eco-friendly agriculture. In this technique farmer can use natural products like cow dung and cow urine of Desi cows as fertilizers and increase disease resistance in crops. This technique allows farmers to invest low and reap profits as much as chemical fertilizers give. Himachal Pradesh government is taking steps to implement this technique in its entire state.

Without solving the above problems and just waving off farm loans is not a good option. Most of the farmers take loans from unofficial sources, so there is no way clearing those debts by government. Even clearing the debts of farmers in banks will encourage bad loan payment practices among farmers. Farmers who are paying loan regularly will stop paying loans, since government is showing a very keen interest in clearing of their debts. In long run banks will consider these farmers as loan defaulters and make it difficult to get a loan for these farmers. So it’s a high time where political parties remove loan waver as part of their manifesto.

Finally, there is still a long and treacherous path for Indian farmer. We import 25% of our nation’s pulse requirement, but produce surplus wheat and rice. We need to educate our farmers to grow crops based on demand basis rather than growing their own traditional crops because they are comfortable in growing them. India’s well being and food security is dependent on them. India needs another Green revolution.